U.S. car manufacturing set to surpass 2000 peak

Car production in North America is thriving, with U.S. car exports exceeding a staggering two million. As AutoBlog reports, 2014’s numbers are “just shy” of the record set in 2000. Last year, U.S. factories exported 2.1 million cars, the highest number in history, with around 50% of the exports going to Mexico and Canada, and an increasing number shipped to China and the Middle East. That’s an 8% increase since 2013 and a 73% increase since 2004, according to information released last week by the U.S. International Trade Administration.

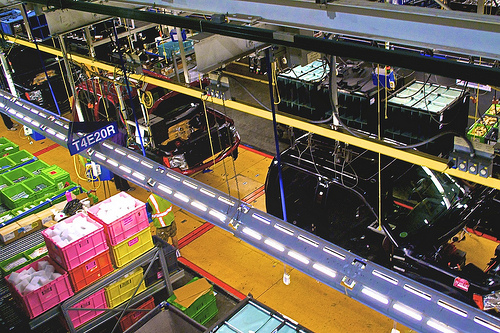

xxx TK TK Image from Nicole Yeary.

Those 2.1 million vehicle exports equate to around 18% of all new vehicles produced in the U.S., according to the Wall Street Journal and WardsAuto.com: “U.S. light-vehicle production was 11.4 million in 2014. And the U.S. is still a big importer of foreign-made cars and SUVs. The U.S. auto trade deficit was about $109.4 billion last year.” In Mexico, auto manufacturers produced around 3.2 million vehicles in 2014, which represents a 10% jump since 2013, and exported around 82%, with the majority of the cars exported to the U.S.

What’s behind the uptick? Post-recession, it has been cheaper to build vehicles in the U.S. Plus, as AutoBlog explains, “buyers around the world are going crazy for crossovers,” with Mercedes-Benz and BMW, for example, exporting the bulk of their U.S. production of these car models abroad. Honda, too, has been “shipping more models out of the country than it imported here” in the United States.

“The U.S. has become one of the low-cost places to build cars,” Ron Harbour, of Oliver Wyman Inc., a management consulting firm, told the Wall Street Journal. Automakers are also broadening the type of vehicles that they export. “What’s happening is car makers are exporting out of the U.S. into a broader range of markets,” Mike Jackson, director at IHS Automotive, explained to the Journal.

When the dollar was particularly weak, explains Automotive News, German and Japanese auto manufacturers and suppliers broadened their presence here in the U.S. “More recently, Volkswagen came up with a grand North American strategy. The U.S. share of foreign brands went from 25% in 1995 to 55% today.” While carmakers claim they do not make “short-term decisions based on currency movements,” the dollar had been weak for long enough that it “effectively reshaped the global industry.” Yet that may be changing as the dollar continues to strengthen. “Now — barring a dramatic shift in currencies — the trend is over.”

While impact on American manufacturing is yet to be determined, the rise in the dollar’s value will make the U.S. a “more lucrative place” to sell vehicles that are produced elsewhere, explains the Journal. “Everybody outside of the U.S. is going to start looking at [this] country with a more endearing look,” Fiat Chrysler Automobiles Chief Executive Sergio Marchionne said at last month’s North American International Auto Show. “All the Europeans, all the Japanese will start looking at this market in a much more affectionate fashion than they’ve done in the past.”

Related Posts

Category: Transportation